oklahoma franchise tax online filing

FRANCHISE TAX REQUIREMENT FOR FILING A FRANCHISE TAX RETURN All foreign non-Oklahoma corporations including non-profits must pay an annual registered agent fee of 10000. The maximum annual franchise tax is 2000000.

What Is Franchise Tax Overview Who Pays It More

We would like to show you a description here but the site wont allow us.

. 52 50 4 credit card service fee. Click Here to Start Over. If a foreign corporation one domiciled.

To avoid delinquent penalty and interest for late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. The Comptrollers office has amended Rule. The maximum annual franchise tax is 2000000.

You will be automatically redirected to the home page or you may click below to return immediately. To file your Annual Franchise Tax Online. Form 200-F must be filed no later than July 1.

You can also complete the filing online. The franchise tax payment is due at the same time as the corporate income tax. When a corporations franchise tax liability is zero the corporation must still file an annual franchise tax return.

Approved Electronic Filing Products Approved as of January 1 2022 For 2021 Tax Year Products. Use the Oklahoma Secretary of State website to download a blank certificate form you can complete this form and mail it to the Oklahoma Secretary of. Box 26930 Oklahoma City OK 73126-0930 Changes in Pre-Printed Information.

Go to the Oklahoma Taxpayer Access Point OkTAP login page. The franchise tax fee for corporations is based on capital investments and will be different for each company. FRANCHISE TAX Requirement for Filing a Franchise Tax Return All foreign non-Oklahoma corporations including non-profits must pay an Annual Registered Agent Fee of 10000.

Central Time shorter wait times normally occur from 8-10 am. Complete the Oklahoma Certificate of Incorporation. Further similar to the income tax the filing extension does not extend the due date for payment of the franchise tax.

Enter your username and password. Submit and pay the filing fee. Complete OTC Form 200-F.

Scroll down the page until you find Oklahoma Annual Franchise. Franchise Tax Computation The basis for computing Oklahoma Franchise Tax is the balance sheet as shown by your books of account at the close of the last preceding. Changes to Franchise Tax Nexus.

You can create an account by clicking Register here To file your Annual Franchise Tax by Mail. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma. FRANCHISE TAX REQUIREMENT FOR FILING A FRANCHISE TAX RETURN All foreign non-Oklahoma corporations including non-profits must pay an annual registered agent fee of 10000.

Only those corporations with capital of 20100000 or more are required to remit the franchise tax. The return will not be. Please have your 11-digit taxpayer number ready when you call.

The maximum annual franchise tax is 2000000. Indicate this amount on line 13 of the Form 512-S page 6. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives.

On the Oklahoma Tax Commission website go to the Business Forms page. The maximum amount of franchise tax that a corporation may pay is 2000000. Oklahoma franchise excise tax is levied and assessed at the rate of 125 per 100000 or fraction thereof on the amount of capital allocated or employed in Oklahoma.

Oklahoma has an annual filing fee of 25 for LLCs payable online using a credit card or through the mail with a check made out to the Oklahoma Secretary of State. While we are available Monday through Friday 8 am-5 pm. Indicate this amount on line 13 of the Form 512 page 6.

The report and tax will be delinquent if not paid on or before August 31 and. You will need to specify one tax account type for OkTAP access at the time of registration. After you have filed the request to change your filing period you will not need to file this form again.

Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form 512. Our legal name and address in oklahoma ok are. When to File The tax is due on July 1.

Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay. Under Domestic Organizations select Domestic Profit Corporation Enter your name and email address. Access can be added to additional accounts through OkTAP after you have registered.

Request to Change Franchise Tax Filing Period. Online Filing - Individuals Use Tax - Individual E-File Income CARS Sales Use Rate Locator Payment Options Tax Professionals. Our Mission is to serve the people of Oklahoma by promoting tax compliance through quality service and fair.

Oklahoma Tax Commission Franchise Tax PO. The following is the Tax Commissions mission statement as it exemplifies our direction and focus. Indicate this amount on line 13 of the Form 512 page 6.

To file online submit a Business Entity Filing on the Oklahoma Secretary of State website. You may file this form online or download it at taxokgov. Corporations not making the combined franchise and income tax election must file a stand-alone Oklahoma franchise tax return by July 1st of the calendar year.

Submit separate Form 512 pages 6-9 for each company within the consolidation. For additional information see our Call Tips and Peak Schedule webpage. Oklahomas franchise tax is a tax on corporations for the privilege of doing business in the state.

However the IRS and the respective State Tax Agencies require you to e-file a Federal Income Tax Return. You can change your filing date by filing Form 200-F Request to Change Franchise Tax Filing Period by mail or online using OkTAP Oklahomas online filing system by July 1st. Visit us at wwwtaxokgov to file your Franchise Tax Return.

To register as a new OkTAP user click the Register Now button on the top right of the OkTAP homepage and complete the required fields.

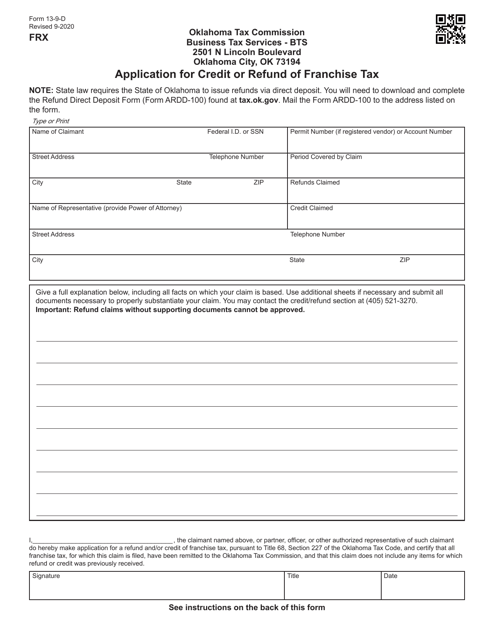

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

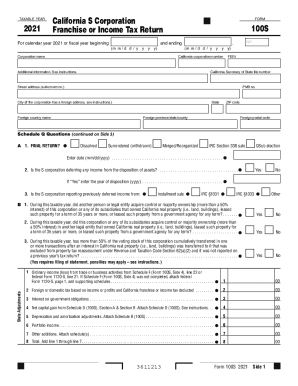

Ca Form 100s Instructions Fill Out And Sign Printable Pdf Template Signnow

Home One Stop Taxes Tax Services Starting A Business Tax

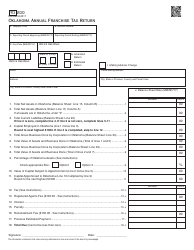

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

What Is Privilege Tax Types Rates Due Dates More

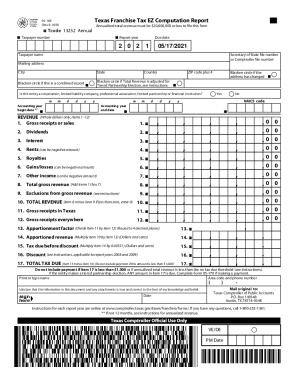

Texas Franchise Tax Report Report Year And Accounting Period Explained C Brian Streig Cpa

Alabama Franchise Tax Return Fill Online Printable Fillable Blank Pdffiller

State Accepts Installment Agreement In Los Angeles Ca 20 20 Tax Resolution

What Is Franchise Tax Legalzoom Com

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

How To Form An Llc In Massachusetts Llc Filing Ma Swyft Filings

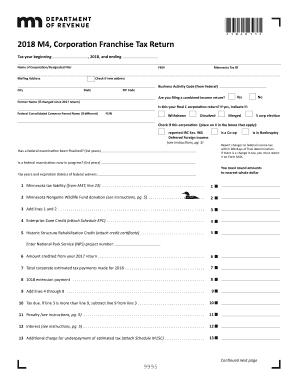

Mn Form M4 Instructions 2020 Fill Out And Sign Printable Pdf Template Signnow

Arkansas Franchise Tax Instructions Fill Online Printable Fillable Blank Pdffiller

05 169 Texas Franchise Tax E Z Computation Annual Report Fill Out And Sign Printable Pdf Template Signnow

Delaware Annual Report Filing File Online Today Zenbusiness Inc

Franchise Tax What Is It Fundsnet

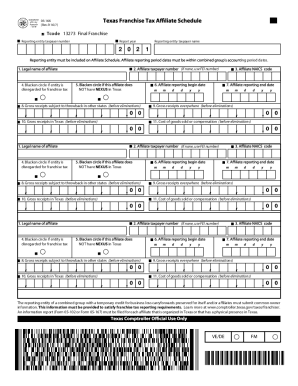

Get And Sign 05 166 Texas Franchise Tax Affiliate Schedule For Final Report 2021 2022 Form

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller